Each year, the Associated General Contractors of Alaska and Construction Industry Progress Fund work with McKinley Research Group to compile a Construction Spending Forecast. Below is an excerpt of the forecast, which can be found in full at agcak.org/news-publications/, or by scanning the QR code at right with your mobile device.

Each year, the Associated General Contractors of Alaska and Construction Industry Progress Fund work with McKinley Research Group to compile a Construction Spending Forecast. Below is an excerpt of the forecast, which can be found in full at agcak.org/news-publications/, or by scanning the QR code at right with your mobile device.

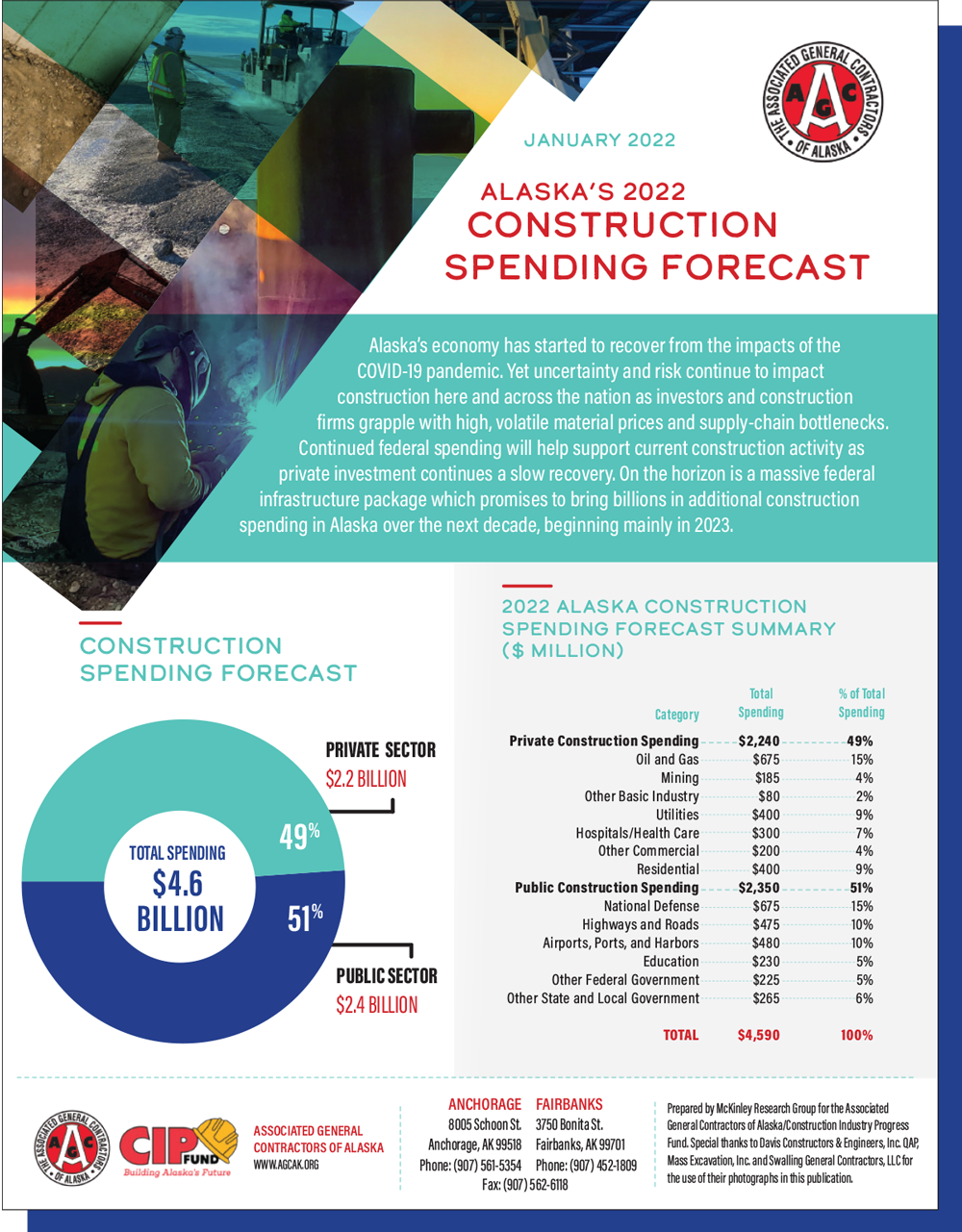

laska’s economy has started to recover from the impacts of the COVID-19 pandemic. Yet uncertainty and risk continue to impact construction here and across the nation as investors and construction firms grapple with high, volatile material prices and supply-chain bottlenecks. Continued federal spending will help support current construction activity as private investment continues a slow recovery. On the horizon is a massive federal infrastructure package which promises to bring billions in additional construction spending in Alaska over the next decade, beginning mainly in 2023.

$400 MILLION

Housing demand in the Fairbanks area will continue to reflect the Eielson Air Force Base F-35 fighter installment through 2022.

$675 million

$185 million

$80 million

$300 million

Commercial $200 million

Work includes projects such as the 601 W. Fifth (formerly KeyBank) Building in Anchorage, Nuvision Credit Union in Wasilla, and renovations to vacant commercial space in downtown Kodiak. Air cargo and logistics projects valued at $1 billion are expected to get underway at Ted Stevens Anchorage International Airport in 2022.

$400 million

& Railroad $480 million

$225 million

GVMT. $265 million

$230 million

$475 million

$675 million