Photo provided by GCI

Photo provided by GCI

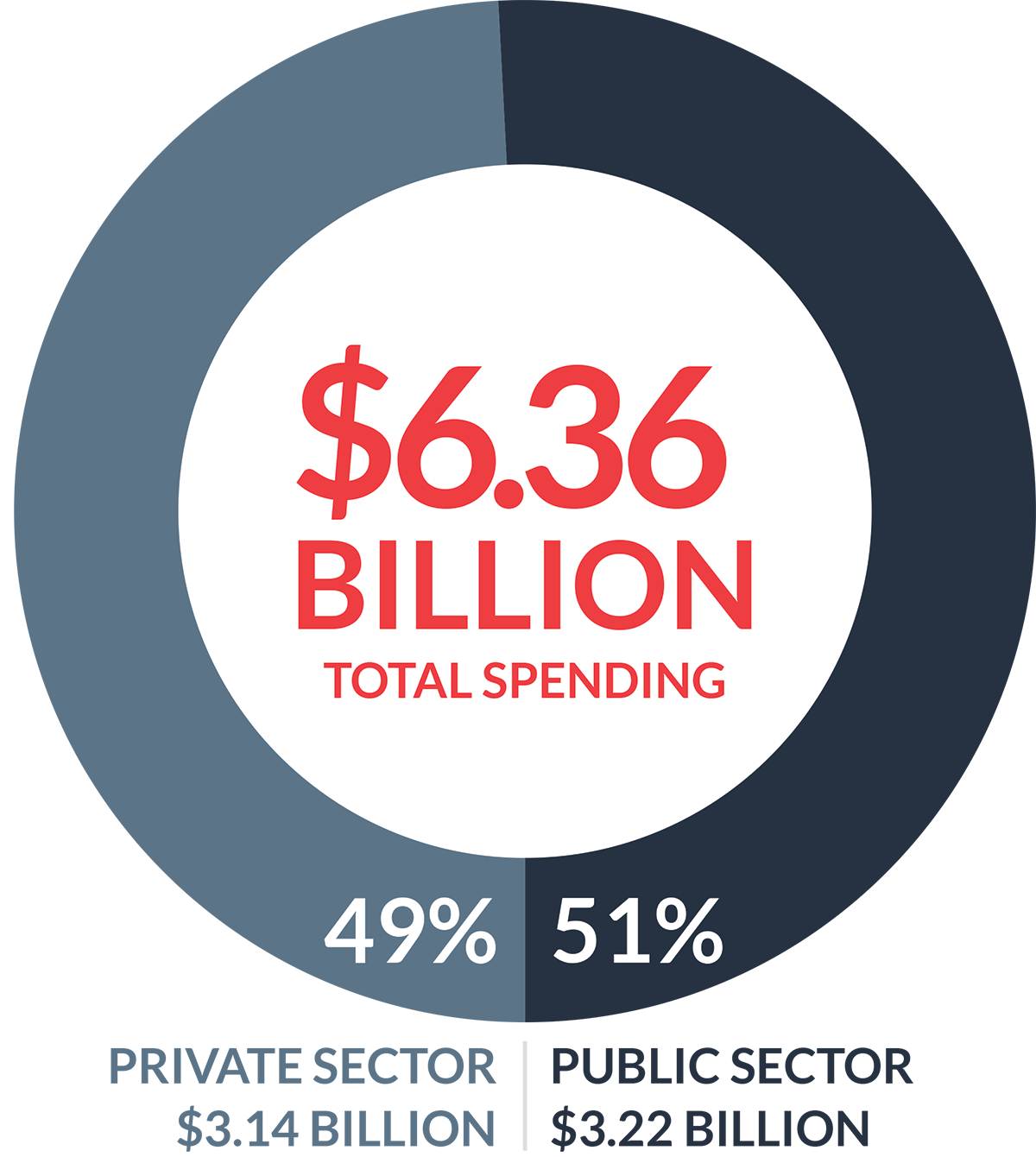

ignificant federal infrastructure funding and the acceleration of oil project development on Alaska’s North Slope are expected to drive statewide construction spending over the next several years. Two years into the five-year federal Infrastructure Investment and Jobs Act, or IIJA, funding authorization, significant transportation, water and wastewater, energy, and broadband funding have been allocated to Alaska’s state and local governments, tribal entities, and others. Meanwhile, oil and gas production and exploration companies expect to spend $14 billion on capital expenditures over the next five years. Amid these positive signals for the state’s construction industry, high interest rates, and a limited construction workforce pose risks to investment in many sectors.

Photo provided by Davis Constructors & Engineers

-

Oil and Gas

$1,160

-

Utilities

$700

-

Residential

$405

-

Hospitals/Healthcare

$260

-

Mining

$165

-

Other Basic Industry

$90

-

Other Commercial

$360

-

SECTOR TOTAL

$3,140

Photo provided by Brice, Inc.

-

Highways & Roads

$805

-

National Defense

$600

-

Airports, Ports, and Harbors

$565

-

Education

$335

-

Other State and Local Government

$535

-

Other Federal Government

$380

-

SECTOR TOTAL

$3,220

Photo provided by Knik Construction