hen industry analysts consider the 2022 construction season and the difficulties contractors have faced not just with the onset of summer, but since the beginning of the COVID-19 pandemic, only one word seems fitting: unprecedented.

“The truth of the matter is, while normally price inflation or supply issues are part of the equation, this is beyond the scope of what’s normal,” says Brian Perlberg, senior counsel of construction law and contracts for Associated General Contractors, or AGC, of America. “It really has been a crisis for the industry for over a year. And it’s not just rising fuel prices; it’s all sorts of things.”

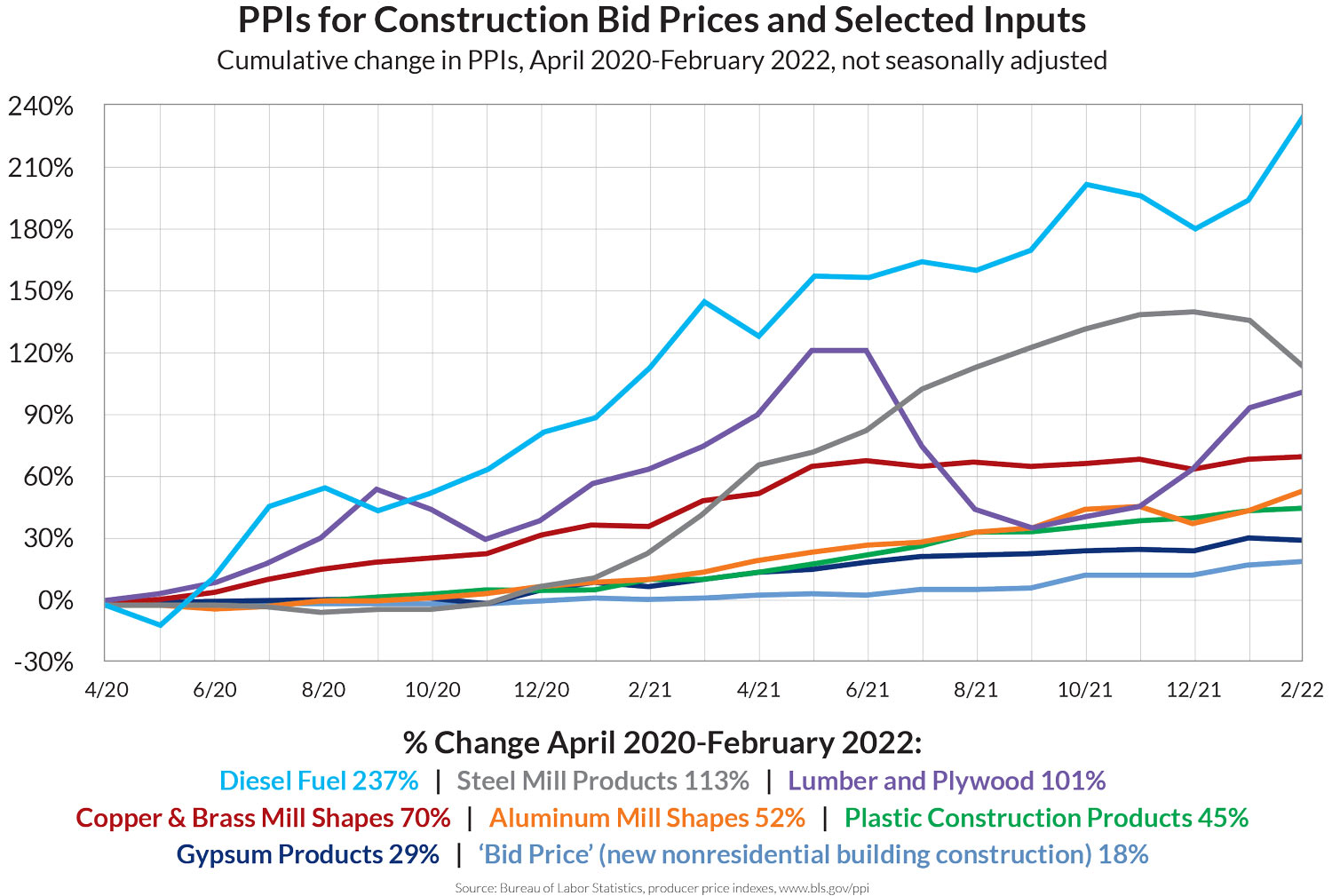

“Labor and inflation have always been an issue, but to have so many things going up in price so much, it’s close to unprecedented,” Simonson says.

“That’s a key ingredient I wouldn’t have thought of,” Simonson says. “He used to be able to order it from a supplier and it would be there the next day. Now he has to call up six suppliers. There are a lot of unexpected shortages that might seem trivial but can hold up an entire project.”

Availability and delivery times have affected the construction industry since the early days of the pandemic. Since then, supply chain issues have only become more pronounced, as a series of unforeseeable circumstances have interfered with the production and delivery of materials: a shortage of computer chips and semiconductors resulted in delays of construction equipment deliveries, while wildfires have affected lumber supplies. Meanwhile, the war in Ukraine has not only sent fuel prices soaring, it’s resulted in the diversion or delay of ships carrying a variety of supplies.

In most cases, supply chain issues mean longer wait times for materials. But in some cases, items are showing up unexpectedly early, making it necessary for contractors to warehouse and insure some products until they can be used.

The rising cost of fuel is a common complaint among average drivers—but for contractors, the impact of high fuel prices is felt in more than one way.

Contractors use significant fuel for their own trucks and equipment, while their employees often drive long distances to remote spots to work. Construction jobs also require “thousands of deliveries of materials and equipment and hauling away of dirt and debris,” Simonson adds. Finally, diesel power is used to run most of the equipment on a job site throughout a project.

“All of those things require fuel,” says Simonson.

Fuel surcharges also impact the price of deliveries and materials—though, as Simonson points out, the timing of when materials are ordered and how fuel prices may affect the cost of delivery can vary a great deal.

“Increasingly,” he says, “we hear suppliers saying, ‘We won’t quote a price until we put [the product] on a truck.’ That makes it hard to budget for your project.”

The retail price of diesel fuel jumped $1.30 or 33% in just 5 weeks to an all-time high on March 14

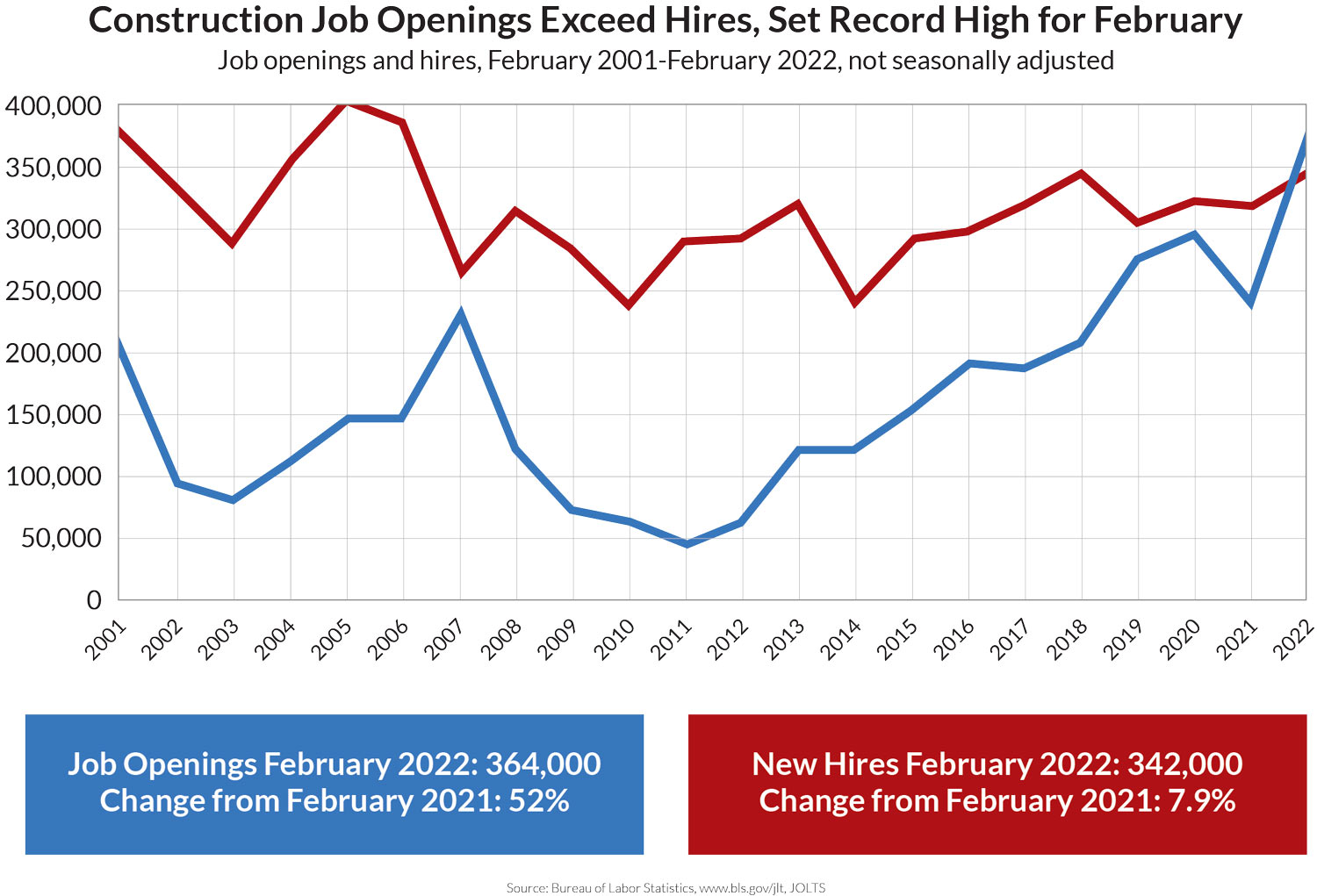

From February to April 2020—just two months—the industry saw a 15 percent loss of employees, according to the most recent Construction Inflation Alert. After that, employment stalled significantly.

While seasonally adjusted construction employment was back at 7,628,000 by March, that number represents a significant rebound of residential construction workers, whereas nonresidential construction employment has been at a standstill nationally.

Because many factories likewise haven’t fully restaffed post-COVID, labor shortages are also a factor in disruptions in the supply chain, says Simonson.

“[Factories] just don’t have the reserves or the flexibility in either inventories or staffing to quickly gear up or fill gaps in production,” he says.

“There was a lot of discussion [in the ’70s], and there certainly is now, about price adjustment clauses,” Simonson says, “so that owners are sharing the risk and the potential reward on price changes.”

In fact, according to Perlberg, who is also the executive director and senior counsel for ConsensusDocs, price escalation clauses are the best solution in most cases. “It’s the only industry standard contract document that addresses the issue.”

AGC members can access a “Potentially Time Price-Impacted Materials Amendment” through ConsensusDocs, a repository of standard construction contract documents. The amendment provides a baseline price that’s established from an objective index agreed upon by the contractor and the client up front.

“If prices go up, the contractor provides documentation and receives equitable adjustment,” Perlberg explains. “If prices go down, the owner can do the same and get the money back. It’s an escalation/de-escalation clause that really helps take the uncertainty out of trying to price this unpredictable risk.”

When negotiating a price escalation, he adds, it’s important for contractors to select the right indices for the project. ConsensusDocs also provides a price escalation resource center that can clarify the process—but Perlberg emphasizes that users need to be aware that the materials and objective index should be negotiated on a project-by-project basis.

The number of job openings at the end of February, a record for the month

Non-legal options can also help mitigate against changes in price. Both substitutions of materials and design changes may be necessary when products are delayed or unavailable. Contractors may also consider moving away from a firm-fixed price or design-bid-build contract to a cost-of-work agreement, under which the contractor is paid for all construction-related expenses, plus an agreed-upon profit; contractors may need to establish a guaranteed maximum price in this case.

Above all, Perlberg says, communication is a crucial tool in this climate.

“Nobody wants to be surprised by price increases or delays,” he says. “If there’s communication between your client, you, and your subs and suppliers, you can think about alternatives or design changes.”

There’s no single magic bullet for dealing with today’s industry challenges, but by staying abreast of changes through AGC’s continued updates, industry professionals can keep informed and try to mitigate against the next wave of change.